Abstract

Financial reporting has been mandatory for several decades, due in large part to the realization that it is critical for companies to provide all stakeholders with financial data for investment and market purposes. As a result, there are mandatory standards to follow for financial reporting. In recent years there has been a similar realization regarding the importance of non-financial reporting, particularly Corporate Social Responsibility (CSR), Environmental, Social, Governance (ESG), and sustainability reporting, all of which take into consideration the effects that companies have on the environment and society. There are many standards for these similar and often interchangeable reporting structures, but there are none that are mandatory. Companies can choose whichever they deem best to highlight areas they want and hide specifics they do not want to report. Mandatory standards, like those adopted in the financial arena, are needed to ensure all organizations follow the same reporting process subject to differentiation between certain scopes, such as company size and industry. It is essential that all companies disclose all relevant information in a manner that is reliable, transparent, and readily available for public viewing; harmonization of CSR, ESG, and sustainability reporting standards is necessary for this to occur. This article addresses the importance of accurate and standardized CSR, ESG, and sustainability data for both companies and stakeholders, as well as the current state of standardization efforts, particularly in the European Union.

1. Introduction

Reported ESG metrics now greatly factor in consumer preference and investment activities, with 72 percent of hedge fund managers citing growing interest among investors as the biggest driver for them to embrace ESG principles (KPMG, 2021). This means it is beneficial for businesses to disclose data and metrics relating to sustainability; however, if the data is not standardized, it may be of limited value when it comes to creating real, positive impacts on the environment. In addition to voluntary reporting of ESG data, there are 40 countries that currently use carbon pricing mechanisms to actively reduce carbon levels from industry (World Bank, 2021). The current carbon pricing schemes cover more than 50% of all emissions in these markets, which translates to just under 15% of global emissions. This is a start, but it is not yet enough to make a real difference in reducing emissions. Voluntary carbon credit issuances are becoming more popular since they can be included in ESG reports to show progress in company sustainability, but there are also issues with standardizing carbon offsets. Companies can claim they have offset emissions and reduced their carbon levels without stakeholders being certain that they have been adequately accounted for or reported correctly. There are essentially no rules when it comes to reporting carbon emissions or offsets.

Presenting reliable, accurate sustainability data is challenging work. There are no uniform requirements for reporting ESG information, and many environmental and social impacts are hard to measure, making data inputs fundamentally less structured, less complete, and of lower quality than financial data. There exists the potential for a more standardized reporting structure for ESG data in the near future, but at present it is all voluntary and can follow any number of reporting guidelines, or none at all. The current lack of rules and robust metrics makes it difficult to ascertain reliable data.

While sustainability-focused practices, particularly those involving CSR and ESG metrics, have become important to many corporations and most large firms voluntarily report this data, there is substantial heterogeneity in disclosures because there are no mandatories or even commonly agreed upon standards. This heterogeneity makes it difficult for stakeholders to use and compare data, which, even with the best intentions, may prevent realizing the full benefits of even the best-intentioned CSR activities and ESG-related measures.

2. Current ESG, CSR, and sustainability reporting standards

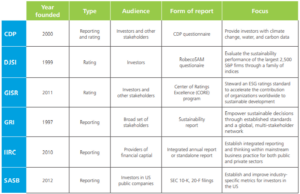

Given the rapid uptake of sustainability reporting in response to market drivers for better acknowledgement and performance pertaining to environmental and social issues, there has been a development of a wide range of standards and tools since the turn of the millennium. There are currently more than 40 standard-setting and reporting initiatives that are accredited in some manner and are used by various companies across the world. Of these, there are six main initiatives that have emerged as leading standards utilized much more frequently than the rest (Deloitte, 2016). This leading six comprises Carbon Disclosure Project (CDP), the Dow Jones Sustainability Index (DJSI), the Global Initiative for Sustainability Ratings (GISR), the Global Reporting Initiative (GRI), the Integrated Reporting Framework (IIRC), and the Sustainability Accounting Standards Board (SASB). More information on each of these initiatives is provided in Figure 1 below.

Figure 1: Most commonly referenced CSR/ESG/sustainability standard-setting and reporting initiatives

Source: Deloitte (2016). Sustainability disclosure: Getting ahead of the curve.

In addition to these standards, there are tools such as the AA1000 and CDP’s inter alia (Siew et al., 2015). These tools, collectively referred to as corporate sustainability reporting tools (SRTs), serve to inform companies of their progress towards achieving sustainability goals. However, as with the increasing number of reporting standards and a lack of homogenized standardization, the number of SRTs is rapidly growing, with increasing criteria and methodologies that create undue complications for stakeholders.

3. Calls for and against harmonization of ESG, CSR, and sustainability reporting

Due to the lack of consensus over what data should be mandatory for sustainability reporting purposes, and the need for ease of comparability across industries and companies, there have been increased calls for a global harmonization of CSR, ESG, and sustainability reporting standards, particularly over the past year in the last 18 months. The IFRS Foundation’s ISSB, set to launch at COP26 in November 2021, is a promising standard that has been endorsed by the Group of Five, the World Economic Forum International Business Council (WEF IBC), and the International Organization of Securities Commissions (IOSCO). Extensive consultation with stakeholders has resulted in an urgent need for a high-quality, global, sustainability-related financial reporting framework, and the G7 Finance Ministers and Central Bank Governors have expressed support for the ISSB, calling for mandatory climate-related financial disclosures based on the Task Force on Climate-related Financial Disclosures (TCFD) framework. This has the potential to be a useful and needed implementation, though it falls short of a full standardization framework for reporting all material CSR and ESG metrics that should be taken into consideration when addressing sustainability impacts. Implementing a larger, more thorough framework is needed to standardize sustainability reporting as a whole.

However, there are some that resist or outright reject any need for homogenized and standardized reporting. A recent paper (Adams et al., 2021) critically examines the call for harmonisation of sustainability reporting frameworks and standards that occurred alongside an increase in ESG investing during the COVID-19 pandemic. The authors claim that calls for harmonisation seek to simplify sustainability reporting and ESG analysis and shift the control for standard-setting to an investor-oriented private sector body. They argue that the calls for homogenized standardization are based on deception, misunderstandings, and disregard for both academic research and the views of sustainability practitioners.

Nevertheless, despite some well-articulated and persuasive resistance, there are strong calls for harmonization from both the financial world as well as from governments aiming at simplifying environmental impact measurements from companies on all areas of society.

4. Future requirements for non-financial reporting, including CSR, ESG and other sustainability metrics

In recent years, the European Union has been increasingly concerned with ensuring more transparency concerning CSR and ESG metrics, which is reflected in the current drive at the European level to push for more harmonization of sustainability reporting standards. This has led to the European Commission publishing a proposal for a new Corporate Sustainability Reporting Directive (CSRD), which occurred on April 21, 2021. The CSRD proposal aims to amend the existing reporting obligation of the Non-Financial Reporting (NFR) Directive (2014/95/EU) and entails several critical changes regarding sustainability reporting for companies of all sizes. According to the proposed directive, ESG reporting will be mandatory for both public and private companies with more than 250 employees across Europe from 2023 onwards. In the case of capital groups, subsidiaries are not required to prepare an ESG report, provided that their activities are included in the report of the parent company. Moreover, the draft proposal also stipulates that ESG reporting must be done by companies with more than 10 employees if they are listed on a regulated market, though this is not slated to come into effect until 2026. Compared to the current criteria for reporting at all levels, the proposed CSRD will significantly expand the catalog of entities that will be obliged to report

5. Key effects of the CSRD directive

The CSRD proposal extends the NFR scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises), requires the audit (assurance) of reported information, and introduces more detailed reporting requirements. It also adds a requirement to report according to mandatory EU sustainability reporting standards and requires companies to digitally ‘tag’ the reported information. This is to ensure information is machine-readable, allowing it to feed into the European single access point envisaged in the capital markets union action plan.

EU rules on non-financial reporting currently apply to large public-interest companies with more than 500 employees, however, as mentioned above, this will drop to all companies with more than 250 employees under the new directive. This covers tens of thousands of companies and groups across the EU, including listed companies, banks, insurance companies, and any companies designated by national authorities as public-interest entities. With regard to what must be published in sustainability reports, the same requirements as NFR Directive 2014/95/EU are in place, meaning large companies must publish information related to environmental matters, social matters (including treatment of employees), respect for human rights, anti-corruption and bribery, and diversity on company boards (in terms of age, gender, educational and professional background).

The European Commission’s proposal for the CSRD envisages the adoption of EU sustainability reporting standards, with draft standards developed by the European Financial Reporting Advisory Group (EFRAG). Each of the harmonization standards will be tailored to EU policies, while building on and contributing to international standardization initiatives. The first set of standards would be adopted by October 2022.

6. Conclusion

While there is some debate as to the need or benefit of harmonizing CSR, ESG, and sustainability reporting, the overwhelming response, particularly in Europe, is to move towards a standardized set of reporting measures and tools to ensure comprehensive and adequate reporting. This has led to the development of the Non-Financial Reporting Directive (NFRD) and the Corporate Sustainability Reporting Directive (CSRD).

The implementation of the CSRD represents a significant challenge that will require the expertise and resources of various units within an organization. From the finance department to the risk management and operations team, everyone will need to start making ESG management decisions in terms of responsibility and commitment to the process

7. References

Ioannou, I., & Serafeim, G. (2017). The consequences of mandatory corporate sustainability reporting. Harvard Business School research working paper, (11-100).

Siew, R. Y. (2015). A review of corporate sustainability reporting tools (SRTs). Journal of environmental management, 164, 180-195.

Buallay, A. (2019). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal.

Adams, C. A., & Abhayawansa, S. (2021). Connecting the COVID-19 pandemic, environmental, social and governance (ESG) investing and calls for ‘harmonisation’ of sustainability reporting. Critical Perspectives on Accounting, 102309.

Sulkowski, A., & Waddock, S. (2012). Beyond sustainability reporting: integrated reporting is practiced, required, and more would be better. U. St. Thomas LJ, 10, 1060.

Folkens, L., & Schneider, P. (2019). Social responsibility and sustainability: How companies and organizations understand their sustainability reporting obligations. In Social Responsibility and Sustainability (pp. 159-188). Springer, Cham.

Oprean-Stan, C., Oncioiu, I., Iuga, I. C., & Stan, S. (2020). Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 12(20), 8536.

Koh, J. K., & Leong, V. (2017). The rise of the sustainability reporting megatrend: A corporate governance perspective. Bus. L. Int’l, 18, 233.

Buhr, N., Gray, R., & Milne, M. J. (2014). Histories, rationales, voluntary standards and future prospects for sustainability reporting: CSR, GRI, IIRC and beyond. In Sustainability accounting and accountability (pp. 69-89). Routledge.

European Commission (2021). Corporate sustainability reporting. https://ec.europa.eu/info/business-economy-euro/company-reporting-and-auditing/company-reporting/corporate-sustainability-reporting_en. Accessed on September 30, 2021.

Directive 2014/95/EU of the European Parliament and of the Council of 22 October 2014 amending Directive 2013/34/EU as regards disclosure of non-financial and diversity information by certain large undertakings and groups Text with EEA relevance. OJ L 330, 15.11.2014, p. 1–9 (BG, ES, CS, DA, DE, ET, EL, EN, FR, HR, IT, LV, LT, HU, MT, NL, PL, PT, RO, SK, SL, FI, SV). ELI: http://data.europa.eu/eli/dir/2014/95/oj